Values and Strategy

Grail's Investment Philosophy

The consistency created by sustainable competitive advantage generates greater investment certainty.

|

|

"The key is not to predict the future, but to be prepared for it!" - Pericles (C. 495 - 429 BC) Greek Orator and Army General |

|

|

"If a stock makes a 20% move or more in 8 weeks it has the potential to make a huge move." - William O'Neil, stock broker and found of the business newspaper Investor's Business Daily |

|

|

Cut your losses and let your profits run! |

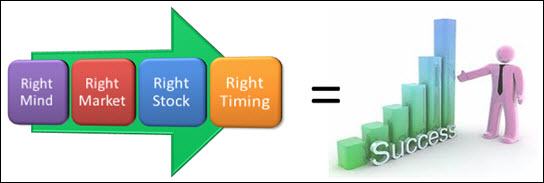

Grail's Strategy - The Four Disciplines

To avoid the pitfalls of emotional behaviour, GEMS's approach is analytic and systematic.

a. The Right Mind means complying with factual analysis and execution.

b. The Right Market means identifying the dominant market trend, and the agents of change.

c. The Right Stock means selection based on sustainable growth drivers.

d. The Right Timing means executing transactons based on GEMS's confirmation signals.

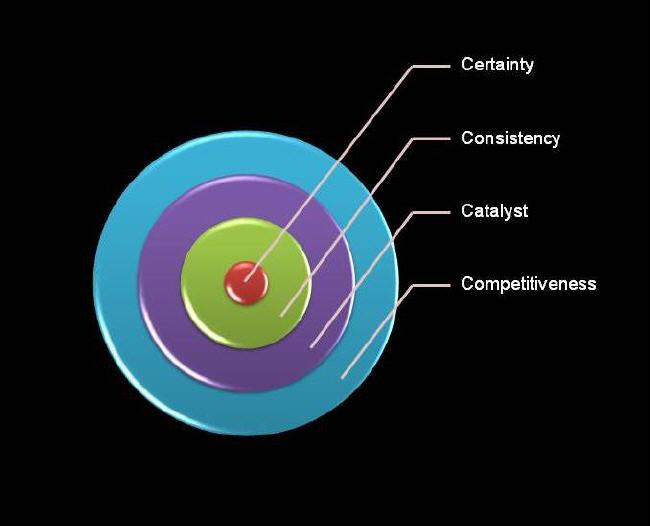

Grail's Strategy - The 4 C's of Stock Selection

|

|

Competitiveness: Industry dominance strategies that make companies market leaders |

|

|

Catalyst: Events that trigger sudden bursts of price velocity and create sustainalble upward trends |

|

|

Consistency: High consistency in the past that generates high expectations of the same consistency in projected earnings growth and positive surprises |

|

|

Certainty: Predictability becomes more certain when stocks continually exceed market expectations |

(c) 2010 - All rights reserved