Performance

Grail's Investment Philosophy

The consistency created by competitive advantage generates greater investment certainty.

Risk and Return

When it comes to stock markets there are many misconceptions about risk and return, some of which are described in the GEMS section. Of course, safety is particularly needed when knowledge and experience is in short supply, particularly in crisis situations, such as we are experiencing in this Coronavirus year. In fact, the greatest investor of all time, Warren Buffet correctly called it when he defined risk as not knowing what you are doing, and thus leads to emotionally-driven losses.

The counter-argument of this is surely that knowledge, the hallmark of quant systems, like Grail Equity Management System (GEMS), not only reduces risk, but is able to generate very high Alpha returns as new opportunities present themselves in each phase of market cycles.

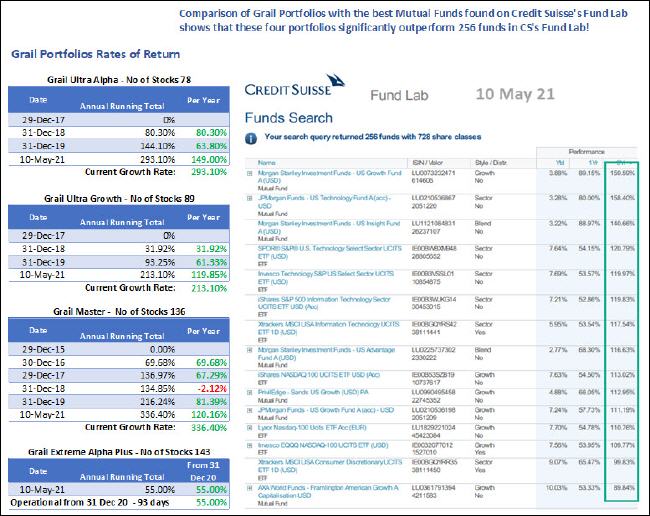

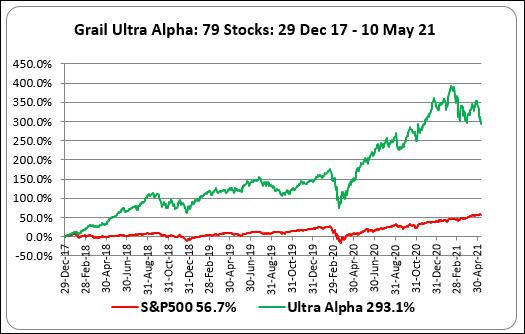

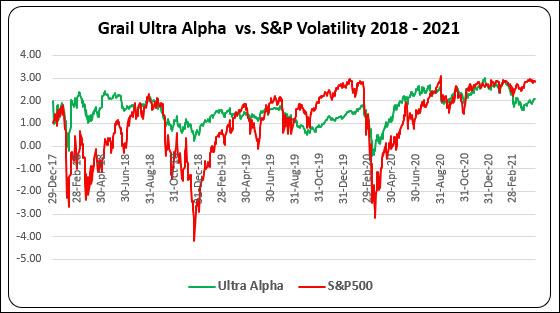

To prove this rationale, the table below compares 4 large Grail portfolios with the best-performing funds in Credit Suisse's Fund Lab at the end of December, 2020. The graph in position 2 is the Ultra Alpha Portfolio, which has a holding of 79 stocks. As per 11 December, the portfolio shows a return of 322%, or an average return of 107% per year, whereas the S&P 500 index's performance in the same period shows a 3-year return of only 37%! The last graph shows that on a Value-at-Risk basis Ultra Alpha is far less volatile than that of the S&P 500 Index! To some this will be a big surprise, especially if they hold the mistaken view that the higher the return, the higher the risk is, when research proves that the opposite is true.

All Grail portfolios are driven by the highest grade quant system (GEMS), which reduces risks to manageable levels, thus enabling the generation of abnormally high returns by an array of unique filters, signals, warnings, and forecasting capabilities, which identify the drivers of sustainable competitive advantages that are confirmed in GEMS's fundamental and technical analyses.

Comparisiom with the best US Mutual Funds

Ultra Alpha Portfolio

Ultra Alpha Portfolio's Value-at-Risk Profile

(c) 2010 - All rights reserved