The Grail Equity Management System (GEMS)

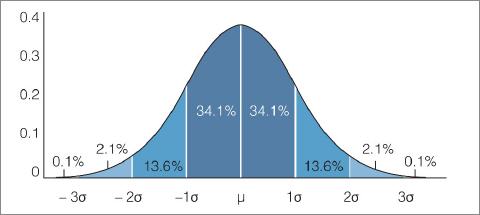

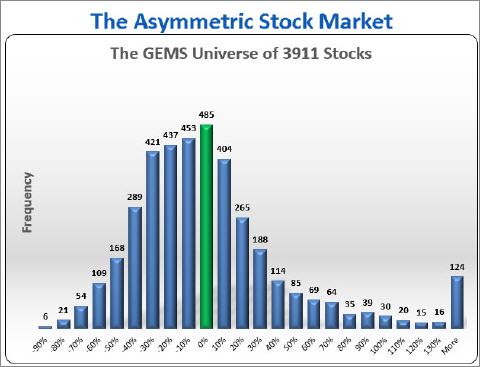

The Grail Equity Management System (GEMS) is a unique momentum and growth model, which was developed through years of research. Thereby it was realized that the conventional wisdom about risk and return was wholly incorrect, because it is based on a static model called the Normal Distribution Curve, see the first graph. However, the stock market histogram shifts continuously, and is normally assymetric, as the second graph below shows, favouring either the positive or negative side of the stock market average. Currently, the stock market has a 46.8 percent bias towards negative returns. How signifiant is this lopsidenness? Very! Because the risk metrics of the normal distribution curve can lead to wrong conclusions. For example, standard deviation, a key metric of volatility around the average, is the metric used to quantify risk, which is in a constant state of change, as shown on the Performance page.

Further, conventional wisdom argues that investment in growth stocks are riskier than the so-called blue chip companies! However this is fundamentally incorrect since growth stocks offer far higher returns, because their products are in higher demand, as reflected in their revenue and earnings growth profiles. Consequently, the second graph on the Performance page shows that the S&P 500 valute-at-risk measurements is far more negatively volatile than the Ultra Alpha portfolio, which conversely possesses far more positive volatility. This is because the S&P 500 includes large-cap stocks, whose sales produce consistently weaker earnings results than Grail selected stocks.

These false assumptions alone act as major inhibitors for investors, who are advised to seek the safety of 'less riskier' stocks, and then find to their dismay that the resulting lower returns can easily be convert into greater relative losses on major market turndowns, the likes of which we saw happended to the S&P 500 from 20 February 2020 to 23 March 2020 when the index lost 33 percent.

GEMS's selected stocks generate absolute returns in U.S. stocks with no more, and even less risk than the S&P 500! The model has been throughly tested over several years and is applied with excellent results in Grail's advisory capacity to its clients. The system focuses on market leaders that elevate to the top 10 percent of the $30 trillion U.S. market. This is because such companies have their highly successful business strategies, which cause strong demand for their stocks. It's that simple!

The Normal Distribution Curve misjudges risk

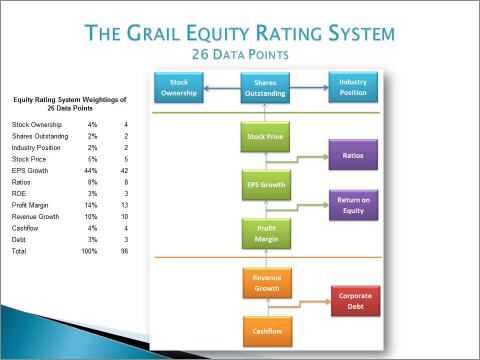

The Basis of Outstandng Stock Selection

To identify high grade stocks GEMS analyzes the drivers of their performance. The graph shows how this is achieved. The Grail Equity Rating System (GERS) applies 26 data points, which are weighted in terms of their relevance to Grail's search for high calibre alpha stocks. As earnings growth is the primary catalyst that drives stock prices 44% of the analysis concentrates on this variable.